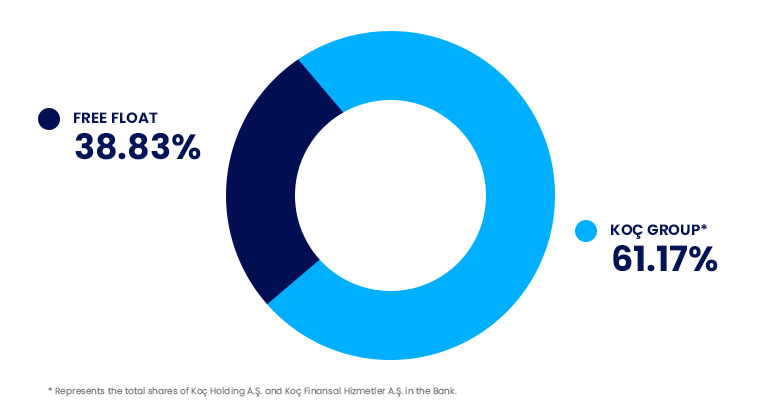

Yapı Kredi has a strong shareholding structure which ensures sustainable and profitable growth. Koç Group owns 61.17% of Yapı Kredi shares. The remaining 38.83% is publicly traded on Borsa Istanbul.

Changes in the Shareholder Structure

25 July 2023 - Koç Group sold 6.81% of the stakes to the market through ABB

- Koç Holding A.Ş. has announced at Public Disclosure Platform that their Yapı Kredi shares representing 6.81% of the Bank’s share capital were sold to institutional investors through accelerated book building.

- Consequently, Koç Groups share in the Bank came down to 61.17%.

- Free Float increased to 38.83%.

1 April 2022 - Finalisation of the 18% share transfer

- The transfer of 18% shares has been finalized and Koç Group’s direct and indirect share in Yapı Kredi increased to 67.99%.

- UniCredit S.p.A. had no remaining shares in the Bank.

- As Koç Holding’s direct and indirect stake in Yapı Kredi exceeded 50% threshold defined in the Capital Markets Board’s (CMB) Communiqué on Takeover Bids, a mandatory tender offer was triggered for Koç Holding for the shares of other Yapı Kredi shareholders. Accordingly, Koç Holding applied to the CMB for conducting a mandatory tender offer.

19 November 2021 - UniCredit sold 2% of the stakes to the market through ABB

- UniCredit S.P.A. has notified the Bank that it has sold its 2% Yapı Kredi shares in Borsa Istanbul as of 19 November 2021.

- As a result of this sale, UniCredit S.p.A.'s ownership at Yapı Kredi has reduced to 18% from 20%.

- As a result the free float increased to 32.03% from 30.03%

9 November 2021 - Koç Holding acquired 18% of Yapı Kredi’s shares from UniCredit.

- Koç Holding had an official announcement regarding the purchase of shares corresponding to 18% of Yapı Kredi’s share capital, which are held by UniCredit. (finalization: 1 April 2022)

6 February 2020 - UniCredit sold 12% of the stakes to the market through ABB

- UniCredit S.P.A. has announced at Public Disclosure Platform that they completed sale of Yapı Kredi shares in their ownership representing c.12% of the Bank’s share capital through accelerated bookbuilding to qualified institutional investors.

- As a result of this sales transaction, UniCredit S.P.A.’s ownership at Yapı Kredi has reduced to 20% and the Bank’s free float increased to 30.03%.

5 February 2020 - Koç Group finalized the acquisition of 9.02% of UniCredit stakes

- The transfer of 9.02% shares has been finalized and Koç Group’s direct and indirect share in Yapı Kredi increased to 49.99%.

- UniCredit’s stake came down to 31.93%

30 November 2019 - Koç Group acquired 9.02% of UniCredit stakes

- Koç Group and UniCredit announced that they reached an agreement regarding the transfer of 9.02% of UniCredit shares in the Bank to Koç Group.

2 October 2006 - Finalisation of Yapı Kredi’s acquisition via Koç Bank

- Koç Bank’s acquisition of Yapı Kredi has been finalised, after the merger of Koç Bank, the share of Koç Group and UniCredit reached to 81.9%, 40.95% of the stakes owned by each.

| Shareholder | Amount of Ordinary Shares

(in Turkish Lira) | Percentage Ownership (%) |

|---|

| Koç Financial Services |

3,459,065,642.23 |

40.95 |

| Koç Holding A.Ş. |

1,707,666,574.00 |

20.22 |

| Other Partners |

3,280,319,067.77 |

38.83 |

| Total |

8,447,051,284.00 |

100.00 |

Koç Group

With an history dating back to 1926, Koç Group is the largest industrial and service company conglomerate in Türkiye, notable for its combined revenues, exports, share in Borsa Istanbul, and employment creation. The Group's combined revenues account for 7% of Türkiye's national income, while its exports constitute approximately 7% of the country's total exports. Koç Holding is the only Turkish company included in the Fortune Global 500 list.

| Major Indicators (2025) |

|---|

| Total Assets |

TL 5,317,600 Million |

| Revenues |

TL 2,757,295 Million |

| Net Income |

TL 22,001 Million |

| |

|---|